One mantra I often repeat to my team is, “Non-obvious insights start with getting close to the customer.” Another way to put this is that innovation is born from customer insight.

I firmly believe that you can’t innovate your way out of box by only paying attention to what is in that box. You have to do the proverbial work of thinking outside the box. And that can only come from lots of contact with the voice of your customer, whether that be videos, sales calls, interviews, etc. Get whatever you can, as often as you can.

I recently attended a UserTesting webinar called, “The Human Side of Banking: Driving Innovation with Customer Insights”. The presenter was Sharla Collins, who is the Director of Consumer Insights & Innovation Research at Ally Bank. She shared Ally’s approach to innovation as a customer insight activity, and it resonated with me and the approach my teams and I have taken over the years.

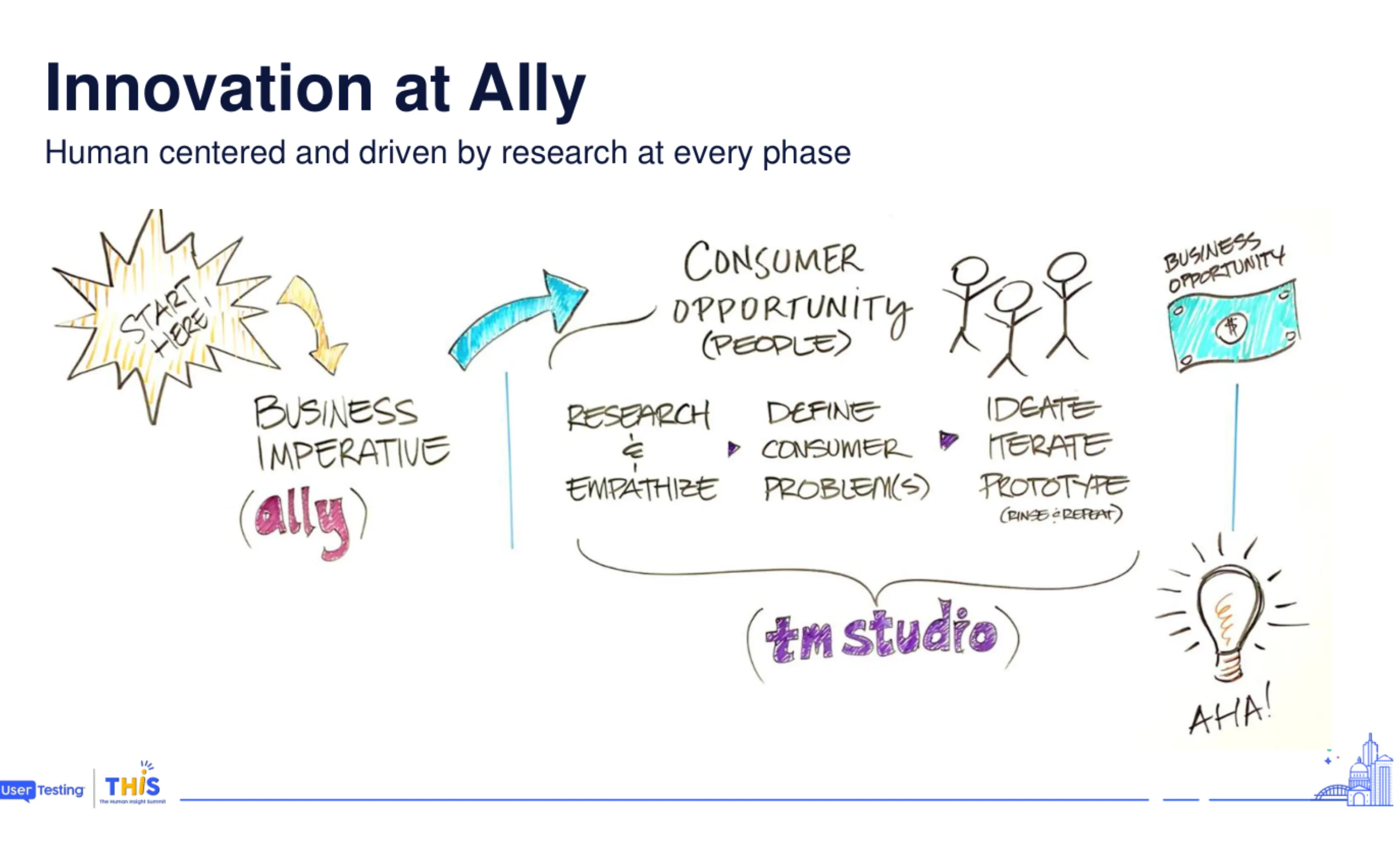

Here’s a slide she shared on their approach:

There’s a couple important things here in this seemingly simple slide.

- Innovation is a cross-section of both business imperatives/opportunities, and customer needs and insights. It’s imperative, of course, that you design products and services that are deeply-rooted in customer needs and insights, but that is only half the equation. You must also meet business imperatives and align with strategy. Lots of product teams have a hard time making the case for innovative designs because they forget this fundamental truth.

- Ally creates the business imperatives, not the research team. It’s important to understand your swim lanes. Many product teams want to be the strategy drivers. That’s not often the job. Often the job is to align product innovation with the business strategy. Unless it’s implicitly clear that product drives overall business strategy, don’t keep trying to fight upstream. Instead, figure out how to build a product that aligns with business strategy, at the intersection of customer insight and business imperatives.

Note: Ally has a distinct studio set aside for customer insights, but any product org can operate this way even if they don’t have a distinct studio.

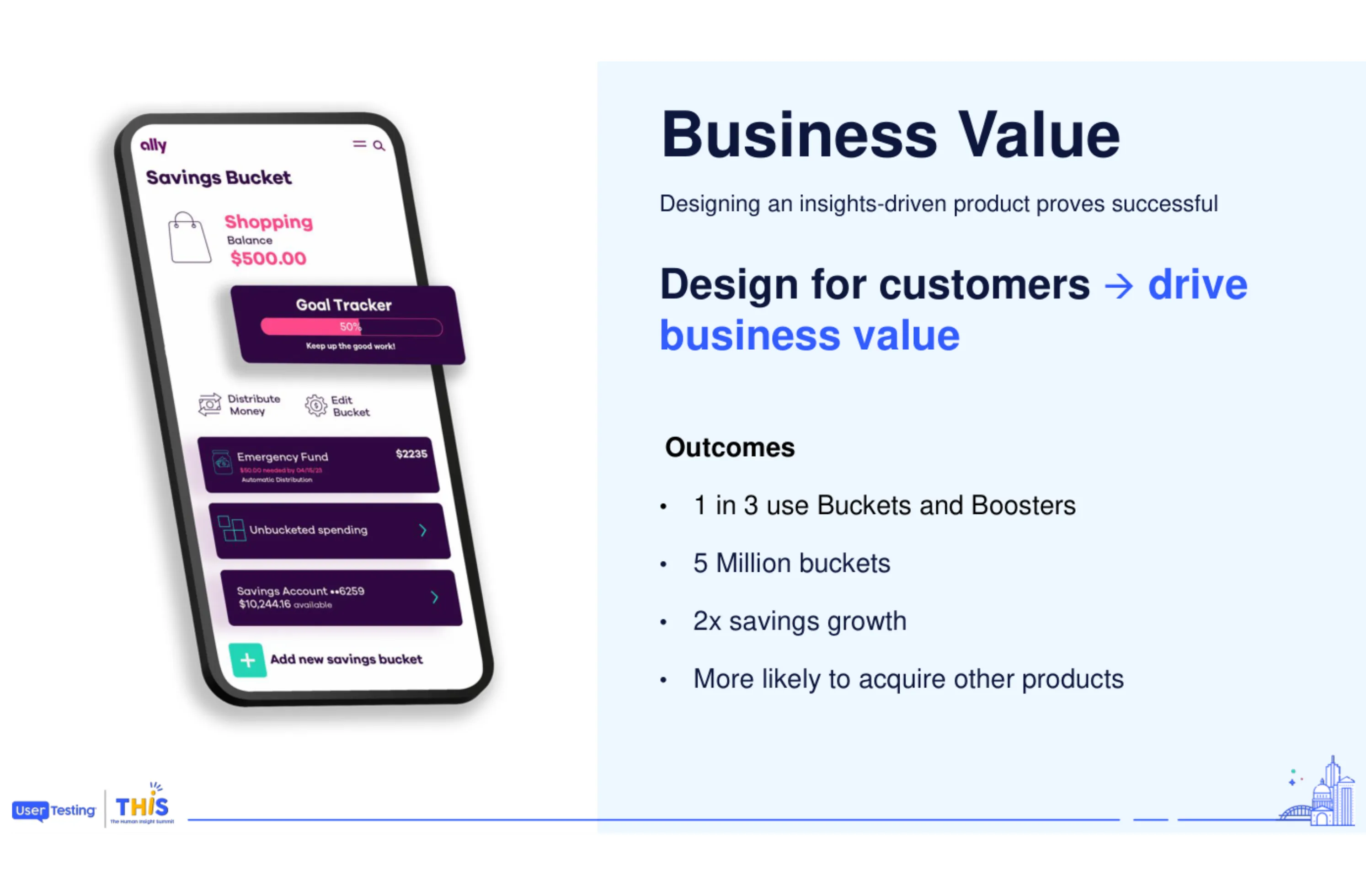

Here’s a great example of how customer insights in action produced insights that created a really cool and innovative product for Ally.

Essentially what they discovered was that everyone knew they needed to save money, and consumers viewed all savings accounts as basically the same. A utilitarian approach.

But they also discovered that the reasons people saved were highly emotional and often very specific. These emotions and specifics, however, lived in the consumer’s head.

Additionally, people wanted to save more and realize their mental models faster.

Using these customer insights, Sharla Collins and her team developed a savings account product that was, at the time, quite distinct from the basic and commoditized savings account products on the market. It had three core innovations:

- Buckets: Ways for people to organize and track the specific things they’re saving for, layered on top of the savings account.

- Boosters: Finding easy ways to automate savings

- Additional tools: To track and motivate

The simple insight of the job to be done shifting from “saving” to “saving for…” led to an extremely successful innovation in their savings account offering that was truly differentiating…and drove business outcomes. Magic.

This also led to even more data insights. As Collins points out, 5 million buckets is really 5 million data points on what consumers are most interested in saving for. Data that is actually hard to get at scale, even if you’re reguarly interviewing customers.

I love this example because it drives home that non-obvious insights start with customer insights. The thing about non-obvious insights always seem obvious in hindsight. If you look at the product that Ally created, it seems like a no-duh product. But no one ever made it up to that point. Ally connected those customer insights to business imperatives, and viola, a magic trick happened. It’s now copied many times over and seems obvious. But it wasn’t. What would have been obvious at the time was maybe a savings account with lower fees or costs. And that’s what a lot of teams would have built, if they were on the usual product autopilot.

So, the challenge for you (and for me) and your teams (and my team), is how can you take a fresh look at anything in your roadmap and ask, “Are we operating from customer insights to create non-obvious solutions, or are we operating from internal assumptions and market approaches to do what everyone else is doing to solve our customer problems?”

The million-dollar question: which do you think will drive better business outcomes?